What is a Leveraged ESOP & How Does it Work?

There are two types of employee stock ownership plans (ESOPs) – leveraged ESOP and non-leveraged ESOP. Both are qualified retirement plans used by privately-held companies, but how they are funded and structured are slightly different. Leveraged plans are the more common arrangement, at least during initial formation, which is why we want to focus on them in this post.

Leveraged ESOP Defined

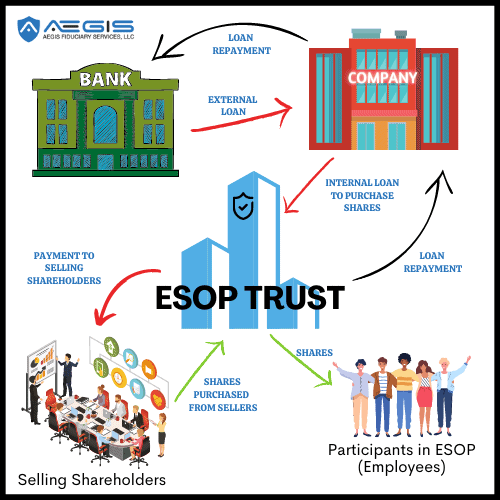

Leveraged ESOPs are a type of employer-sponsored retirement plan and are often also used as a business transition tool for a retiring owner. The company that establishes an ESOP is referred to as the plan sponsor. In a leveraged ESOP transaction, the plan sponsor takes out a loan, “leveraging” their own credit to fund the plan via an ESOP trust. The trust then uses those funds to purchase company shares or stock and pay back the loan over time. An ESOP essentially provides a market for a company’s own stock. Shares are distributed to the accounts of employee participants annually. Participants can take distributions upon retirement, selling their shares back to the company.

How Does a Leveraged ESOP Transaction Work?

- A leveraged transaction is financed via a loan from a lender, often a bank. The company stock is used as loan collateral.

- An ESOP trust is set up to act as the legal shareholder/purchaser of the shares on behalf of employee participants.

- The trust buys the shares/stock from the plan sponsor and holds it until the time comes for annual contributions to be made.

- The plan sponsor makes an annual tax-deductible contribution to the ESOP. The ESOP trust uses those funds to repay the original loan debt.

- As the loan is repaid, the lender releases shares amounting to the value of the amount repaid.

- Those shares are allocated to individual employee accounts.

- Once employees are vested, they are eligible to receive distributions from their ESOP account when they retire or leave the company.

The price of shares is established by an independent appraiser retained by the ESOP trust. Shares cannot be bought or sold for more than fair market value, which is why an annual appraisal is required.

Tax Considerations

Leveraged ESOPs provide tax advantages to both the sponsoring employer and employee participants.

- Employer contributions are tax-deductible.

- Any dividends paid by the employer and used to repay the loan or paid to plan participants are tax-deductible.

- The company owner/seller is able to sell shares while also postponing paying capital gains on the sale proceeds.

- Employees are not taxed on the shares until they take a distribution.

Advantages

There are a number of tangible and intangible benefits to forming an ESOP.

- It creates an immediate, ready market for selling privately held company stock.

- A company can set up this employee benefit without needing to have all of the required capital upfront.

- A leveraged transaction can be funded with pre-tax dollars.

- Plan sponsors receive a tax deduction equal to the amount of the fair market value of the shares contributed to the ESOP.

- The selling owner can avoid capital gains taxes if conditions are met.

- Employees receive financial rewards that are directly tied to company performance and, by extension, their work contributions. This can have a dramatic, positive effect on employee morale and company culture.

- The founder can sell their ownership interest in the business but still retain operational control of the company, allowing for a gradual transition to new management.

Disadvantages

As with any investment, there are downsides to forming a leveraged ESOP.

- The sponsoring company must qualify for a loan and find a willing lender.

- As a stock ownership plan, there is an inherent risk common to all stock-based investments.

- Company owners are limited to selling their shares at fair market value.

- There is a lack of stock diversification in employee accounts.

- ESOPs are subject to strict rules and regulations under, and reporting to, ERISA, the IRS, and the DOL.

- Requires an annual appraisal process.

- Requires the assistance of qualified outside professionals to administer the plan and form the trust.

- The trust is required to repurchase shares from retirees seeking distributions.

- Can give the appearance of a higher debt-to-income ratio on company accounting records.

The Difference Between Leveraged ESOP vs. Non-Leveraged ESOP

Leveraged and non-leveraged ESOPs both provide tax advantages, benefits to employees, and benefits to employers. The primary difference between the two is in the way they are funded and how shares are dispersed.

- A leveraged ESOP is funded by a loan with company stock used as collateral. A non-leveraged ESOP is not funded by a loan.

- A leveraged ESOP allocates shares to employee accounts as they are released by the lender upon the loan being repaid. A non-leveraged ESOP allocates either cash or shares to employee accounts at specific times during the year.

- A leveraged ESOP cannot distribute shares until the loan has been paid off. A non-leveraged ESOP must distribute shares no less than one year after the close of the plan year during which the participant became eligible for distribution.

Although an ESOP may start out as leveraged, it can become non-leveraged when the loan is paid in full. Likewise, a non-leveraged ESOP may find itself in need of outside financing due to changing business conditions. In this case, the ESOP may seek out a loan and become leveraged. This kind of financing flexibility is one of the advantages of ESOPs.

Is a Leveraged ESOP Right for You?

A leveraged ESOP can be an effective exit strategy and employee benefit, provide tax advantages, and transform company culture. Learn more about ESOPs at The National Center for Employee Ownership (NCEO) and in their book, Leveraged ESOPs and Employee Buyouts. To find out if a leveraged ESOP makes sense for your business, contact Aegis Trust Company to schedule a consultation.

Ready to find out more?

Get in touch with us to see how we can help your company transition to an ESOP or provide ongoing trustee services.

DISCLAIMER: The Articles displayed on this website do not constitute legal advice, nor do they substitute for the advice of qualified professionals. While the Articles displayed on this website are designed to provide information regarding the subject matter covered, we cannot guarantee the accuracy of any statements contained therein. If any legal advice or expert assistance is required, the services of qualified professionals should be sought.

Read more on the ESOP blog

Tomorrow starts here. Partner with Aegis

ESOPs offer diverse benefits that create a thriving work environment and a lasting legacy.